Affordable Wellness Insurance Options to Secure Your Future

In today's uncertain times, securing sufficient medical insurance coverage is crucial to securing your future health. With a plethora of options available on the market, discovering inexpensive options that fulfill your needs can appear like a daunting task. Nonetheless, recognizing the intricacies of different medical insurance plans and just how they line up with your one-of-a-kind circumstances can make a substantial difference in both your economic security and access to quality medical care. By discovering a series of options from Health and wellness Financial savings Account (HSA) prepares to Group Medical insurance alternatives, you can take proactive steps towards ensuring your peace of mind regarding your wellness and economic security.

Affordable Medical Insurance Marketplace Options

Checking out the selection of affordable wellness insurance coverage market options offered can assist individuals find an ideal strategy that meets their certain needs and budget plan. The health insurance market supplies an array of plans created to offer coverage for necessary health and wellness benefits at various price points. Furthermore, High-Deductible Health Program (HDHPs) combined with Health Cost savings Accounts (HSAs) give a tax-advantaged method to conserve for clinical expenses while providing lower costs and higher deductibles.

Health And Wellness Financial Savings Account (HSA) Strategies

When taking into consideration health and wellness insurance policy choices, one might find that Health and wellness Savings Account (HSA) Plans provide a tax-advantaged way to save for clinical costs. HSAs are individual accounts that enable individuals with high-deductible health strategies to establish apart pre-tax dollars to pay for qualified clinical expenses. Generally, HSA Program offer people with a practical and tax-efficient method to manage their medical care expenses while saving for the future.

Short-Term Health Insurance Policy Solutions

Having covered the advantages of Wellness Cost savings Account (HSA) Plans for handling medical care expenses effectively, it is vital to currently shift emphasis towards talking about Short-Term Wellness Insurance Solutions. Temporary wellness insurance policy generally supplies lower premiums compared to standard health and wellness insurance coverage plans, making it an affordable choice for those seeking short-term coverage without dedicating to a long-term strategy.

One key benefit of temporary medical insurance is its versatility. Policyholders have the flexibility to select the length of insurance coverage, varying from a couple of months to approximately a year, depending on their particular needs. Furthermore, these plans frequently have fast application processes, with coverage beginning as quickly as the next day in many cases. While short-term medical insurance may not cover pre-existing conditions or provide the exact same comprehensive benefits as long-lasting plans, it gives an important service for people requiring prompt, short-term insurance coverage.

Medicaid and CHIP Protection Perks

Team Health Insurance Coverage Program

Provided the important role Medicaid and CHIP play in giving medical care coverage to prone populaces, transitioning to the conversation of Group Wellness Insurance coverage Plans is essential in checking out added opportunities for budget-friendly and comprehensive medical protection. Team Wellness Insurance policy Plans are policies purchased by companies and used to qualified workers as component of their advantages plan. These strategies give protection not just to the employees yet frequently encompass their dependents as well. Among the key advantages of team health and wellness insurance coverage is that it permits the dispersing of risk among a larger swimming pool of individuals, which can lead to lower premiums compared to specific strategies. Additionally, group strategies usually have more thorough coverage options, including preventive treatment, prescription medicines, and expert assessments. Employers might also contribute a considerable portion of the premium expenses, making team medical insurance an appealing and cost-efficient choice for numerous people click here for more and families seeking to secure trusted medical care coverage.

Verdict

To conclude, my website there are various cost effective health and wellness insurance policy choices readily available to safeguard your future. Whether through the Medical Insurance Marketplace, Wellness Interest-bearing accounts plans, temporary insurance coverage solutions, Medicaid and CHIP insurance coverage benefits, or group health insurance coverage strategies, it is crucial to discover and pick the very best alternative that fits your requirements and budget plan. Taking aggressive actions to protect medical insurance protection can offer assurance and monetary protection in the event of unexpected clinical expenses.

Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Joshua Jackson Then & Now!

Joshua Jackson Then & Now! Danny Pintauro Then & Now!

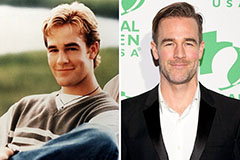

Danny Pintauro Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now!